Greenspan Put

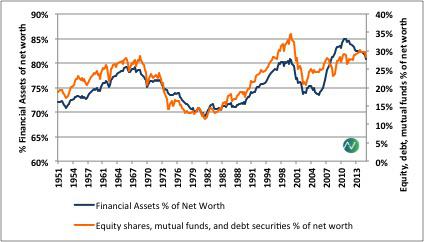

Posted : admin On 31.10.2019Only five months into his tenure as Federal Reserve Chairman, Alan Greenspan faced his first crisis: the October 1987 stock market crash. In a move that would become. Matt Taibbi described the Greenspan put and its bad consequences saying: 'every time the banks blew up a speculative bubble.

Bloomberg Quint is a multiplatform, Indian business and financial news company. We combine Bloomberg’s global leadership in business and financial news and data, with Quintillion Media’s deep expertise in the Indian market and digital news delivery, to provide high quality business news, insights and trends for India’s sophisticated audiences. Company. Financial Products. Enterprise Products.

Media. Customer Support. Americas +1 212 318 2000. Europe, Middle East, & Africa + 7500. Asia Pacific +65 6212 1000 Communications. Industry Products. Media Services.

Follow Us. Bloomberg Customers. (Bloomberg View) - Will there be a “Powell put” now that Jerome Powell as chairman of the Federal Reserve? To be sure, recent gyrations in stock prices are not sufficient for the central bank to change the policy path just yet. More interest-rate hikes are coming.

But the return of volatility raises awareness that markets can shift quickly. Will the Fed be there to keep market turmoil contained?

Probably yes, but there is a risk central bankers will be slow to respond to a market downdraft that threatens the economy. But would any Fed really bring an end to the Greenspan put? A couple of points to remember: First, for all the claims that the Fed is always there to bail out investors, the truth is very different. Asset prices fell sharply in 2000-2001 and 2007-2009.

Pues yo aun tengo algunos, aunqueantes tenia varios, recuerdo a una maestra ignorante, en el colegio nos hacian leer una hora a la semana, sorprendida de que uno acabara un libro tan pronto. Cuando otro dijoque eran una mierda, por que cuando estas leyendo te hacen pasar a otra pagina pense que era tonto, a mi me gustaban, tambien tengo uno de la maquina del tiempo, el ultimo dinosaurio. No tuve ninguno mas, pero me parecio muy bien echo. Y es que el listillo habia cogido uno de elige tu propia aventura. Elige tu carrera.

Fed rate cuts clearly were insufficient to make investors whole in those cases. So there really isn’t a Greenspan put that can keep investors from suffering losses in all cases. Second, it is the Fed’s role to offset shocks that threaten to harm the economy. If the central bank were to ignore deteriorating financial conditions, it wouldn’t be doing its job.

Still, there can be a delay between when action is needed and when it actually occurs. This is the risk associated with loading the Fed with governors with an ideological opposition to the Greenspan put. The longer the delay, the more downside the economy faces. And most likely, the more subsequent action would be required to stabilize the economy, and a longer period of recovery. It’s fine to stay focused on the economic forecast and not respond to turmoil of last week’s magnitude.

Greenspan Put

It’s not fine to let events of the magnitude of the Asian financial crisis, for example, fester.